FAQ: ITC Questions from Investors & Analysts

Tags: fuel cell tax credit

The recently reinstated Federal Fuel Cell Investment Tax Credit has sparked a number of questions about what it is and what it means to Plug Power and its current and potential customers. In this blog, we answer several of the most-asked questions we’ve heard from our investors and analysts.

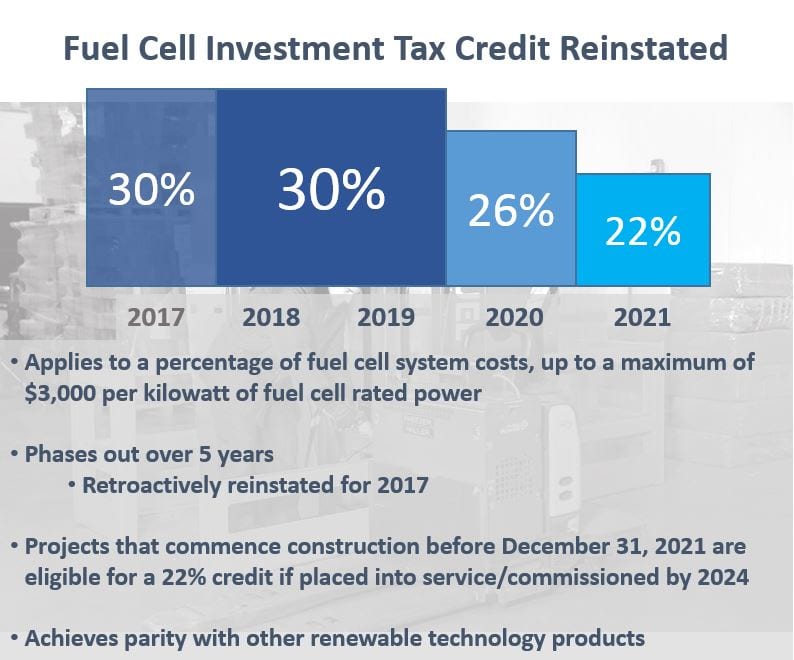

The ITC (investment tax credit) is a federal tax credit, passed into law this past month, that can be claimed by any company that invests in fuel cell and hydrogen installations meeting certain criteria This law, in effect until 2022, allows many of our customers and financing partners to receive an immediate 30% tax credit on their purchases of fuel cell devices. This credit is covered under section 48(a)(3) Investment Credit: Energy Credit of the IRS tax code.

With the reinstated fuel cell tax credit now in place, a level playing field has been reestablished for alternative energy power solutions – a win for the fuel cell industry.

Plug Power sees the ITC as an accelerator for material handling business growth, mostly for 2019 and ongoing years, in terms of long term revenue growth, gross margin enhancements and cash flows. It enables current customers to move quicker, gives potential customers an incentive to try fuel cells and makes the economics for smaller facilities more attractive. While Plug Power has demonstrated the ability to rapidly grow without the investment tax credit, as demonstrated by the Company’s 55% top line growth in 2017, the Company believes the ITC will be an additional accelerator for the business.

“Our customer engagements have significantly accelerated,” Marsh said. “Our customers assumed and our investors assumed that the ITC would never exist. Many are going back and reviewing their business cases.”

How long will the tax credit be available to customers?

Does the ITC protect American jobs?

Hydrogen fuel cells are a “made in America” power solution. According to the Fuel Cell and Hydrogen Energy Association, the entire industry provides more than 10,000 jobs in the United States, and supports tens of thousands of additional jobs through its customers, suppliers and installers. These high-skilled, well-paid workers, are helping America win the tough, global competition for manufacturing.

The fuel cell investment tax credit is an important tool that has enabled the U.S. fuel cell industry to achieve parity with other alternative energy technologies. It’s gotten easier for fuel cells to power the possibilities of American companies again.

#InfiniteDrive